Today is National Equal Pay Day. They say that the average woman has to work from January 1, 2023, through March 12, 2024, to make as much money as a man who worked only in calendar year 2023.

While there are many conversations around the gender pay gap theory (for FAQs about the gender pay gap, read this), it’s still important for employers to ensure that their employees are paid equitably and without regard to race, sex, or any other legally protected characteristic. And it’s increasingly important for employers to be aware of – and comply with – any pay transparency laws that apply to them.

So, in honor of the occasion, here are some tips on how employers can ensure that they are doing the right thing by their employees.

What is pay equity?

“Pay equity” means simply that similarly situated employees are paid the same. Under Title VII of the Civil Rights Act of 1964, protected characteristics are race, sex (including sexual orientation and gender identity, and pregnancy and pregnancy-related conditions), national origin, color, and religion. The Age Discrimination in Employment Act protects individuals who are 40 and older from discrimination based on age. The Americans with Disabilities Act protects qualified individuals with disabilities. Pay disparities based on these characteristics would be a form of discrimination under the applicable laws.

In addition, the Equal Pay Act of 1963 specifically prohibits pay discrimination based on sex.

And, in addition to the above federal laws, many state and local governments have their own pay equity laws, and those laws may apply to people in additional protected categories.

What is pay transparency?

“Pay transparency” refers to laws and regulations that require employers to disclose compensation details, either internally or publicly.

A number of state and local jurisdictions have pay transparency requirements. The specifics vary, but many require employers to provide applicants and employees with salary information, include salary ranges on job listings, and refrain from taking adverse action against employees who discuss their pay.

Nearly half of the states currently have pay transparency laws. California, Colorado, and New York have regulations that apply to all employers. Other state laws, and the laws of some municipalities, apply only to organizations with a certain minimum number of employees.

At the federal level, the National Labor Relations Board takes the position that it is an unfair labor practice for an employer – even a non-union employer – to prohibit employees from discussing their pay, or other terms and conditions of their employment. For federal contractors and subcontractors, the Federal Acquisition Regulatory Council recently issued proposed regulations requiring the disclosure of salary ranges for contract jobs as part of the Biden Administration’s heightened efforts to boost pay equity.

Why it matters

In addition to keeping your company out of legal hot water, pay equity and transparency can foster trust, fairness, and accountability, which can lead to increased job satisfaction, morale, and productivity, and reduced turnover. Moreover, pay transparency can help to attract skilled workers who are drawn to organizations that prioritize fairness and openness.

Finally, most employers want to eliminate biases in compensation because it’s the right thing to do.

Moving toward equity and transparency

The first step in endorsing pay equity and transparency is acknowledging its importance. Human Resources professionals and employment counsel can play a crucial role in communicating this to employers’ leadership teams.

The next step for employers should be to review existing pay policies, with the help of legal counsel, to ensure that the policies comply with all applicable laws. If they don’t, they will need to be updated.

If you are subject to pay transparency requirements, you may need to update your job descriptions and recruiting materials to include information about pay ranges.

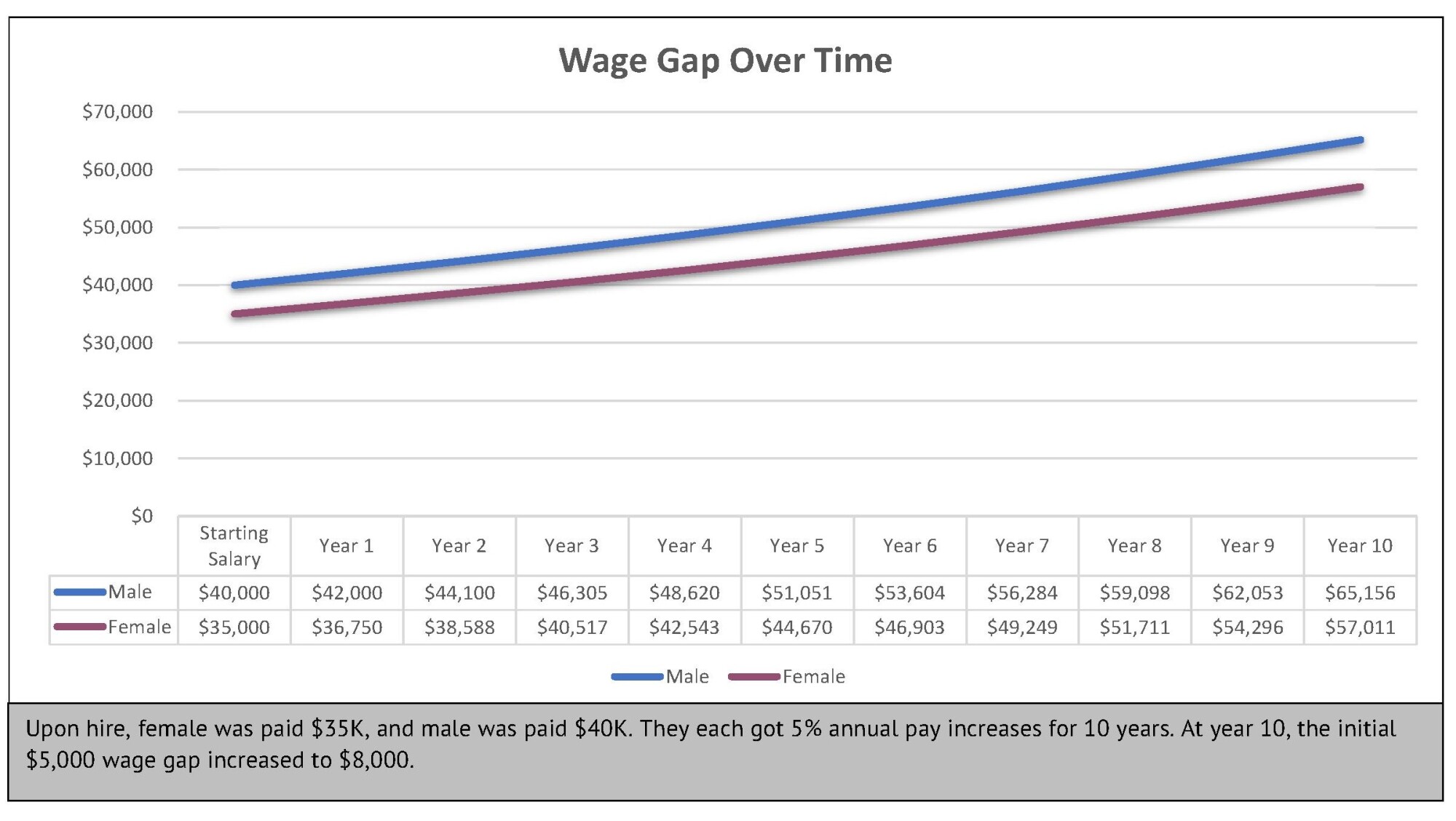

Pay equity analyses and audits are also very helpful and strongly recommended, even on a “preventive” basis (that is, before you get a discrimination charge or a lawsuit). By conducting these audits regularly, you can identify and correct “one-off” disparities, oversights, mistakes, or lingering disparities that resulted from discriminatory practices that are no longer in place. For example, if a woman was hired at a relatively low pay rate in the 1970s, when pay discrimination was illegal but more common than it is now, and if her subsequent pay increases were based on a percentage of her then-existing salary, then the gap between her pay and that of her male counterparts would widen over the years, even if they all received exactly the same percentage increase every year.

Pay analyses and audits can also help you identify and correct any “systemic” issues in your organization that may be resulting in unequal pay, and help you to monitor your company’s progress over time.

When conducting a pay analysis, it is important to have a historical perspective, to gather accurate workforce data, to compare (or contrast) “apples to apples,” and, of course, to take prompt action to rectify any wage discrepancies that don’t have a valid, non-discriminatory explanation.

Do consider involving counsel when conducting any pay analysis to preserve attorney-client privilege to the greatest extent possible.

Finally, it’s a good idea to conduct training to ensure that managers and supervisors understand some basic principles about pay equity and transparency. They are the most likely to be questioned by employees about how pay is determined and to explain any disparities. They should be able to answer basic questions about how pay is determined, although they should be instructed to refer any employee who alleges pay discrimination to Human Resources. In other words, supervisors or managers should not try to explain or rebut alleged pay discrimination themselves. Managers and supervisors generally need to be aware of the following:

- That employees do have a legal right to disclose and discuss their pay.

- That the company sets pay rates for any given job based only on legitimate, non-discriminatory criteria, such as economic conditions and the company’s business condition, performance, length of service, disciplinary action, and the like.

- That employees who believe they have been paid inequitably should raise the issue with Human Resources. HR will investigate and, if the allegations are confirmed, will make corrections, retroactively if necessary.

If your organization could use legal assistance tackling pay transparency and pay equity in your workplace, Constangy attorneys would be happy to help.

- Partner

A trusted advisor to employers, Kristine helps businesses navigate employment law, workplace compliance, and litigation challenges in an ever-evolving legal landscape. She has handled cases across the United States, including ...

Also on Sharpen Your FOCUS: Perspectives on Workplace Diversity

Sharpen Your FOCUS offers timely insights into the legal and practical dimensions of DEI, accessibility, and belonging in the workplace. Drawing from both employer and employee perspectives, we explore emerging topics, shifting legal interpretations, and the real-world impact of inclusive leadership. Thanks for joining the conversation.