New York Employment Law Update

This Client Bulletin provides an update on New York State (NYS) and New York City (NYC) employment law.

Paid Family Leave (NYS)

Beginning January 1, 2018, New York State will have the most comprehensive paid leave program in the country. On that date, eligible employees will be entitled to receive up to eight weeks in paid family leave to care for a family member with a serious health condition (including physical or psychological care); bond with a new child during the first twelve months after the child’s birth or placement for adoption or foster care; or assist with family obligations when a family member is called to active military service. Program benefits increase gradually:

The paid leave program will be funded by deductions from employee paychecks (about one dollar per week) and not from employer tax contributions. To be eligible for paid family leave, an employee must have worked for his or her employer for at least six months. Paid family leave benefits are unavailable for an employee’s own serious health condition.

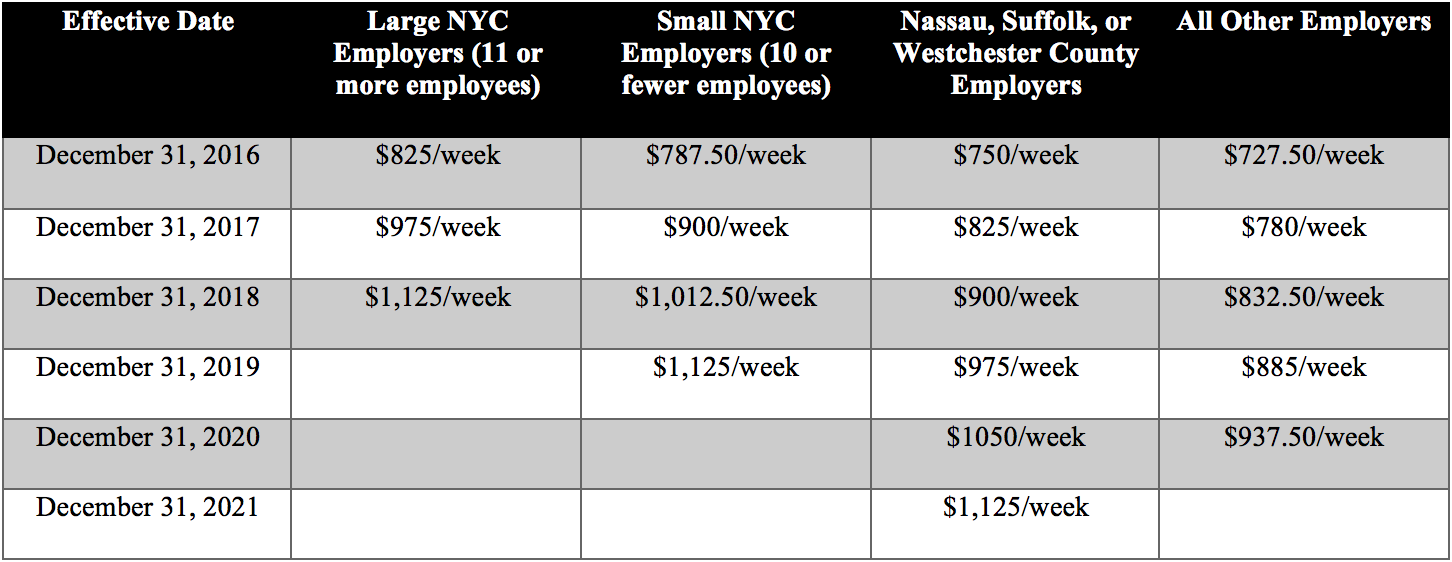

Salary Threshold for Exempt Employees (NYS)

Although the nationwide preliminary injunction on the federal overtime rule is still in effect, New York State employers cannot breathe too easily. Effective December 31, 2016, the New York State Department of Labor (NYSDOL) has increased the salary threshold for executive and administrative employees to count as exempt from overtime. (The NYSDOL does not set a salary threshold for professional employees and, therefore, the federal salary threshold applies.) The salary threshold increases gradually and depends on where the employer is located. In the case of employees in NYC, it also depends on the number of employees:

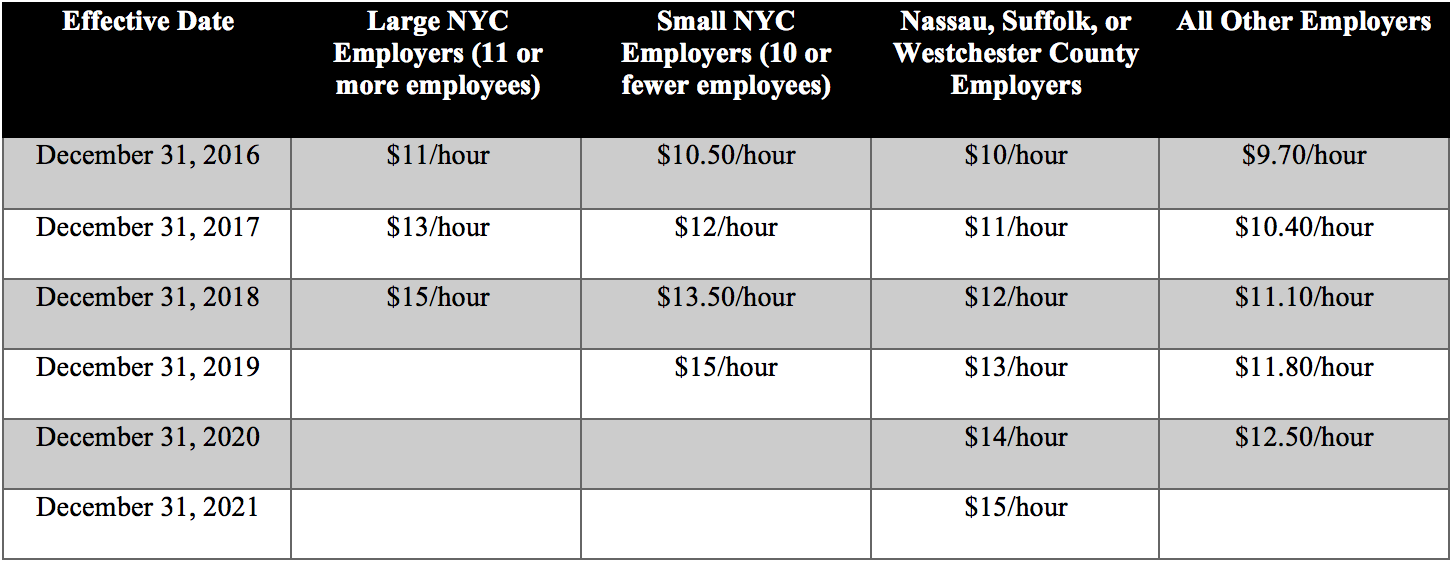

General Minimum Wage (NYS)

The NYSDOL has also increased the minimum wage. As with the salary threshold for exempt employees, the minimum wage increases gradually and depends on employer location and, for NYC employers, their size:

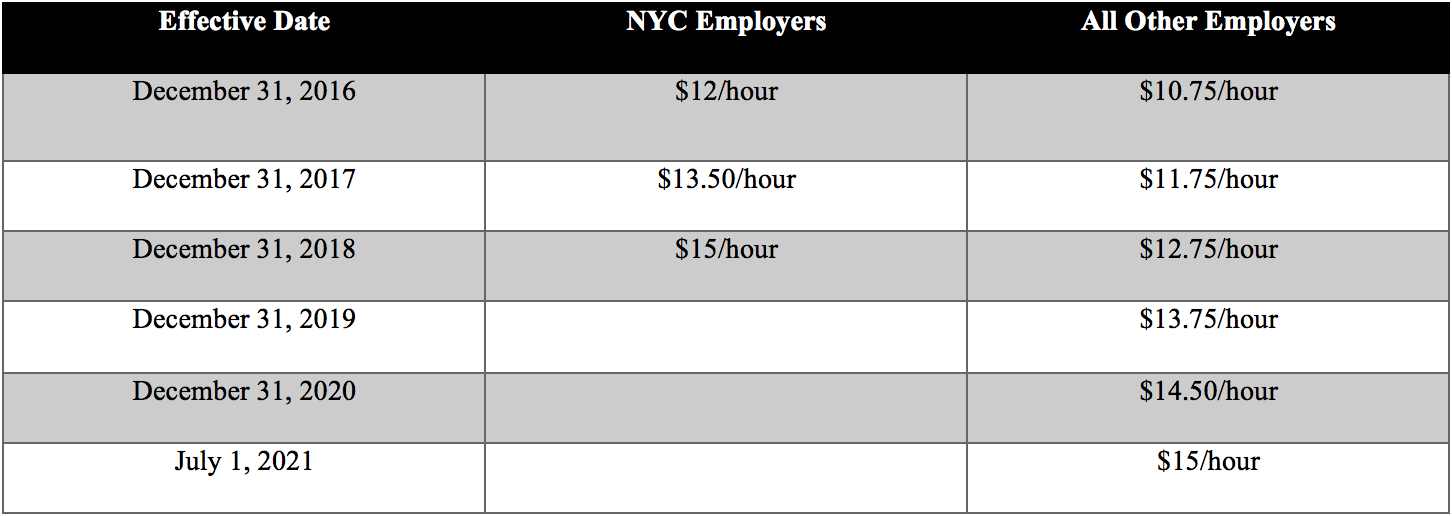

Minimum Wage for Fast Food Workers (NYS)

The NYSDOL has imposed a different minimum wage schedule for fast food workers:

UPDATE (2/20/17): The New York State Industrial Board of Appeals has revoked this rule. Employers with operations in New York State will not be required to comply with it. Constangy will continue to monitor and will keep you informed of any future developments.

The NYSDOL has adopted regulations governing the payment of employees by direct deposit or payroll debit card. The regulations apply to all employees except executives, administrators, and professionals making more than $900 per week (in other words, exempt white-collar employees).

Under the regulations, employers must provide employees with a detailed notice form before paying wages by direct deposit or payroll debit card. That notice form must state in plain language all of the employee’s options for receiving wages (i.e., check, direct deposit, or payroll debit card) and describe the protections available under the regulations. The regulations also require employers to obtain an employee’s written consent—which may be rescinded at any time—before issuing wages via direct deposit or payroll debit card. These notice and consent forms must be provided to employees in English and the employee’s primary language. (The NYSDOL will prepare sample notice and consent forms in the following languages: Spanish, Chinese, Haitian Creole, Korean, Polish, Russian, French, Arabic, Bengali, Tagalog, and Urdu.)

Finally, the regulations impose special requirements for employers using payroll debit card programs. Among other things, those employers must provide access to an ATM located within a reasonable travel distance from the employee’s worksite or home; allow employees to make unlimited no-fee withdrawals; and ensure the funds on the payroll debit card never expire.

A payroll debit card is a card providing access to an account with a financial institution established directly or indirectly by the employer and to which transfers of the employee’s wages are made on an isolated or recurring basis.

The wage payment regulations take effect March 7, 2017.

Freelance Worker Protections (NYC)

On November 16, 2016, New York City Mayor Bill de Blasio signed the Freelance Isn’t Free Act into law. The Act is the nation’s first law protecting freelance workers. The Act defines a freelance worker as “any natural person or any organization composed of no more than one natural person, whether or not incorporated or employing a trade name, that is hired or retained as an independent contractor by a hiring party to provide services in exchange for compensation.” The Act has several components: a written contract with certain essential terms is required for freelance work valued at $800 or more; payment for freelance services must be made within the date specified in the contract or 30 days of the completion of services; and hiring parties are prohibited from retaliating against freelance workers for exercising their rights under the Act. It also provides for various penalties, including statutory damages, double damages, and a civil fine of up to $25,000 if the hiring party is found to have engaged in a pattern or practice of violating the Act.

The Act takes effect May 15, 2017.

Gender-Neutral Bathrooms (NYC)

Effective January 1, 2017, NYC employers in New York City with single-occupancy bathrooms must remove any sign designating those bathrooms as being for a particular gender.

Caregiver Protections (NYC)

As of May 5, 2016, an employer violates the New York City Human Rights Law by discriminating against an employee on the basis of his or her status as a “caregiver.” The statute defines “caregiver” to mean “a person who provides direct and ongoing care for a minor child or care recipient.” The term “care recipient” is defined as “a person with a disability who: (i) is a covered relative, or a person who resides in the caregiver’s household; and (ii) relies on the caregiver for medical care or to meet the needs of daily living.”